“Ride with me”, was Herbert giving you an opportunity to make your presentation while he is dashing to catch a flight or even take another meeting. There was so much activity packed into his life that his car rides often turned into meetings and presentation rooms, with the car of whoever was riding with him trailing Herbert’s car until the meeting was over or Herbert arrived at his next meeting or the airport to catch his flight.

Related to “ride with me” could be “walk with me”. This presented with less time to make your case as he is leaving his office and hurrying into another meeting within the building or dashing to the parking lot to leave for a meeting outside his office premises.

Whichever one “ride with me”, or “walk with me”, there was always frenetic motion involved.

Always fast paced.

He was always in a hurry.

It is instructive that Access Bank staff refer to themselves as Warriors.

For context, there is a scene in the 2006 movie “300” (co-written and directed by Zack Snyder) that epitomizes what an “Access Warrior”. “300” is a fictionalized retelling of the ancient battle of Thermopylae (Hot Gates) in the Greco-Persian wars, King Leonidas and 300 Spartans fight against Xerxes and his massive Persian army.

Arriving with his men to forge an alliance with Sparta and disappointed at seeing a small band of Spartans, the following dialogue ensued between Daxos, a commander of the King of Arcadia and King Leonidas when they met as they were heading to Thermopylae.

Daxos: I see I was wrong to expect Sparta’s commitment to at least match our own.

King Leonidas: Doesn’t it?

[points to an Arcadian soldier behind Daxos]King Leonidas: You there, what is your profession?

Arcadian Soldier: I am a potter… sir.

King Leonidas: [points to another soldier] And you, Arcadian, what is your profession?

Arcadian Soldier 2: Sculptor, sir.

King Leonidas: Sculptor.

[turns to a third soldier]King Leonidas: You?

Arcadian Soldier 3: Blacksmith.

King Leonidas: [turns back shouting] SPARTANS! What is YOUR profession?

Spartans: AHUU! AHUUUU! AHUUUUU!

King Leonidas: [turning to Daxos] You see, old friend? I brought more soldiers than you did!

Despite the small staff strength at the time, the idea that was instilled in every Access Warrior’s mind was that the bank brought more soldiers than competition. Simply by the intensive classroom and on the job training, mentoring and dedication, one Access Warrior in the marketplace had the staying power and capacity of several of his or her counterparts in other financial institutions.

That was the mentality that drove the Access Warrior!

So, it was never a good thing if while making a presentation or defending a credit at Management Credit Committee Herbert or Aigboje were to ask you, “Are we giving you more than you can handle?”

Essentially, there is nothing that an Access Warrior should not be able to handle. Right there is an appraisal issue and is usually not exactly spontaneous but comes from having observed the individual for a while.

On the other hand, “Who do you report to?” could be either good for you and a bad thing for your direct boss, a bad thing for you and your direct boss, or a bad thing for your direct boss, depending on the quality of your presentation and your bosses’ known strengths and performance.

Access people will understand this!

One key thing working with Herbert taught me is that if you are slatted to attend a meeting with him, always be over prepared, even if you are not the one scheduled to make the pitch. Midway into his opening pitch, the man can point to you and tell the client, “My colleague Jekwu will take us through the rest of the presentation”.

Hey God!

If you like, don’t be ready!

In one of my earlier tributes, someone reminded me that this is how you will be defending your credit proposal at Management Credit Committee and feeling very cool with yourself until Herbert says, “Okay! Let me tell you five things that can go wrong” and proceeds to list those five things. As you listen, you will literally see the credit approval promise you made to the client evaporate just before you are possibly asked to step-down the credit and represent with amendments or receive an outright rejection.

Nothing is ever left to chance.

Herbert will often say that the reason he and Aigboje got far in their careers was because they are perpetually paranoid. Hardly any new regulation or policy takes them by surprise because during regular forecasts for the macro, they would have raised them as possibilities in scenario planning and built in plans to take advantage of or mitigate them.

Another thing was their Executive Presence.

The duo always presents themselves and communicated in a manner that conveyed a strong and charismatic professional presence, exuding character, confidence, competence and credibility, and thus it is expected that to be part of their professional circle, you present yourself accordingly.

Let me share an old war story about Access Bank’s 2007 OTC Global Depository Receipts (GDR) out of London.

I was Project Director for Access Bank’s 2007 Public Offer comprising a N70 Billion Local Public Offer (total Offer subscription was N240 Billion, over 242% over subscription), and an Over the Counter (OTC) Global Depository Receipt (GDR) out of London.

On the even of the GDR placement roadshow, I recall taking an early flight out of Lagos to London. This was during Access Holding’s small beginnings, before private jets, when the boys were still flying business class and senior managers like me could only fly economy class.

Arriving London, luggage and all (without checking into my hotel) to rendezvous with the team; Herbert, Aigboje and Roosevelt, I headed straight for the Lanesbourough Hotel where our Financial Advisors, JP Morgan and Renaissance Capital had reserved a conference room and a small meeting room that was to serve as our staging ground.

There was little sleep that day. The entire night was spent reviewing and rehearsing our pitch of “Access Bank’s compelling growth story” that we had already spent the preceding three months or more going through. Each of us rehearsed the presentation to the point that we could go though the entire pitch deck without looking at the slides, aligned the appropriate anecdotes, anticipated all possible questions, developed the appropriate answers and rehearsed our responses to all possible questions.

By the time I was heading to my hotel room early in the morning, I felt like a coiled cobra ready to strike. Despite that, when the SUVs that our Financial Advisors arranged for the GDR roadshow arrived to pick us up, I had butterflies in my stomach, but one look at the aura of youthful energy, power character, the entire Executive Presence emanating from the team, gave me hope.

As we walked through the shopfloor of the first private equity (PE) firm we were to pitch to, I saw all the oyibo’s looking up from their bank of flickering screens and could literally see the look in their eyes of, who are these power Africans?

We were told that the investor we came to see had a private jet waiting to head to Moscow which was why we took this call first.

I will never forget this first pitch.

Launched by Aigboje with Herbert in support and Roosevelt and I to pitch in if necessary, it went like magic. The guy thanked us for coming and dashed off to catch his flight.

After that, I wondered, “what next?”. I didn’t know what to expect. But we sha headed off to the next appointment. It was on our way that we were informed that the first PE firm that we pitched had put in a quote for US$250 Million.

This was the entire GDR placement size!

You can imagine the energy! Inexperienced me, thought we could then pack up and go home. Sebi, we have been ‘given’ all the money we want? Why waste time with the approximately 50 to 70 other possible investors. But I learnt that to reduce concentration risk that we needed to get as many investors quotes as possible then prorate their bids in allocating to them.

The second PE firm quoted another US$250 Million…so did the third I believe and the more presentations we took, the more confident we got.

At the end of the day, of a GDR offer size of US$250 Million, we received total quotes of US$1.95 Billion (over subscribed by 700%) and eventually absorbed only US$300 Million, an increase of US$50 Million from the original offer size.

So, let me ask, who do you think such shareholders would support if they had an opportunity to vote, the guys who presented and own the transformation agenda that informed their investment or the investors who want to control the bank that they know nothing about?

Herbert and Aigboje were what? 41 years old at the time (I was 34 and Roosevelt was 33) and we received quotes of US$1.95 Billion from investors. We can argue that market sentiments and liquidity was different at the time but how many Nigerian 41-year-olds then and now will Oyibo investors willing entrust US$1.95 Billion to the company they run, in a single fund-raising round?

That is why when I hear the recent heckle of “how did he buy Access Bank?” my response (if I am up to it) is often, “who told you that he bought (as in, “owns”) the bank? He does not need to own the bank to control it.

In actual fact, Herbert’s direct shareholding in Access Bank is less than 5% (I believe he probably has other indirect shareholdings) and between him and Aigboje hold direct shareholding of less than 10%.

Tony Elumelu’s direct shareholding in UBA is less than 7%.

These guys cannot be said to own the institutions. Access Holdings Plc is “owned’ by its over 1,000,000 domestic and foreign investors. Once an institution goes public and is listed on the stock exchange then it can be controlled by the largest alliance of shareholders, all they need do is summon an Extraordinary General Meeting and takeover.

That was exactly what happened to Access Bank in 2002. The Bank was established as a private entity in 1989 but went public in 1998. Once that happened, leadership of the bank was open to whoever majority shareholders supported.

Prior to 2002, the Bank was very poorly run, was bleeding cash, then came to the market to raise capital via a public offer.

I can’t remember the size of that offer but suffice to say that it was Underwritten. For those who don’t understand what this means, underwritten implies that the Bank got an issuing house to guarantee that the target funds will be raised and if not the issuing house will provide the funds.

For a poorly performing bank, this was a reckless gamble, not because the newly issued shares will necessarily give an outsider control of the bank, but combined with the shares of existing shareholders who were not happy the way the bank was being run, the leadership could be ousted.

Herbert and Aigboje were already looking for a bank to acquire and the guys at old Access Bank gifted them an opportunity of a lifetime. At the time, the minimum regulatory capital for banks in Nigeria was N2 Billion (so the offer could only have been a fraction of it) and between the duo, their combined Staff Investment Trust Investments in GT Bank gave them sufficient capital for a leveraged buyout.

When the original public offer which had tanked suddenly started performing exponentially, even I who wasn’t vested in the capital markets at the time was suspicious. I read an interview by Access Bank where they opined that the performance of their public offer was an indication of the market’s confidence in their leadership, and I cringed.

Of course, the rest is history. Once the offer was approved. Herbert and Aigboje approached some of the existing major Shareholders to whom they pitched their 7-year transformation agenda and got over to their coalition, with a mandate to move the bank from 65th position to top 10 by 2007. This is what gave them control of them bank, based on which they summoned an EGM, where they took over.

An indication that Access Bank was poorly run prior to Herbert and Aigboje’s takeover, was that in the first year of their takeover, the bank’s balance sheet increased by 100%, and the N1 Billion PBT was more than it’s aggregate profit from inception in 1989 to 2001. This marked the beginning of what would be a six-year record triple-digit growth trend.

Why wouldn’t the other shareholders support the new leadership?

I read a piece where someone referred to takeover as abracadabra and my only response was that a little knowledge is truly a dangerous thing.

There is a reason listed companies are worried when their share price is lightweight compared to the value of the company. They immediately become a sitting duck for a corporate raider who can acquire the company and possibly break it up to extract value or run it properly to create value for all stakeholders.

There is a reason some listed companies build in defence mechanism against hostile takeovers, structure their shareholding to insulate such vulnerability and protect them from such Corporate raiders. Back in the day some listed companies in Nigeria would have about 30% of their shares held by their Staff Investment Trust (SIT), combined with the shares of their Executives, making it impossible for anyone to take control in a hostile takeover.

Though I first studied these things in business school finance modules, it was those early days at Access Bank working with Herbert that gave me the real-world experience of leveraged buyouts, mergers and acquisitions, particularly hostile acquisitions, mergers by absorption, and Greenmail.

For this I am eternally grateful.

When I say that working with Herbert directly for most of the 25 years of my working career is like acquiring several ivy league Doctoral degrees in Business Administration by immersion, this is what I mean!

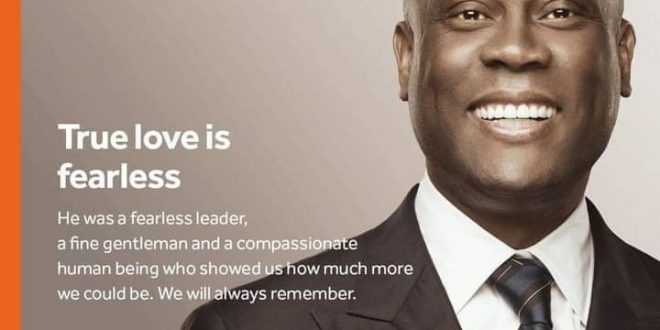

Confident and powerful communicator, charismatic leader, deeply knowledgeable, utterly fearless!

That is/was Herbie.

#RememberingHerbertWigwe

#Fearlessleader

Hottestgistnaija.com

Hottestgistnaija.com